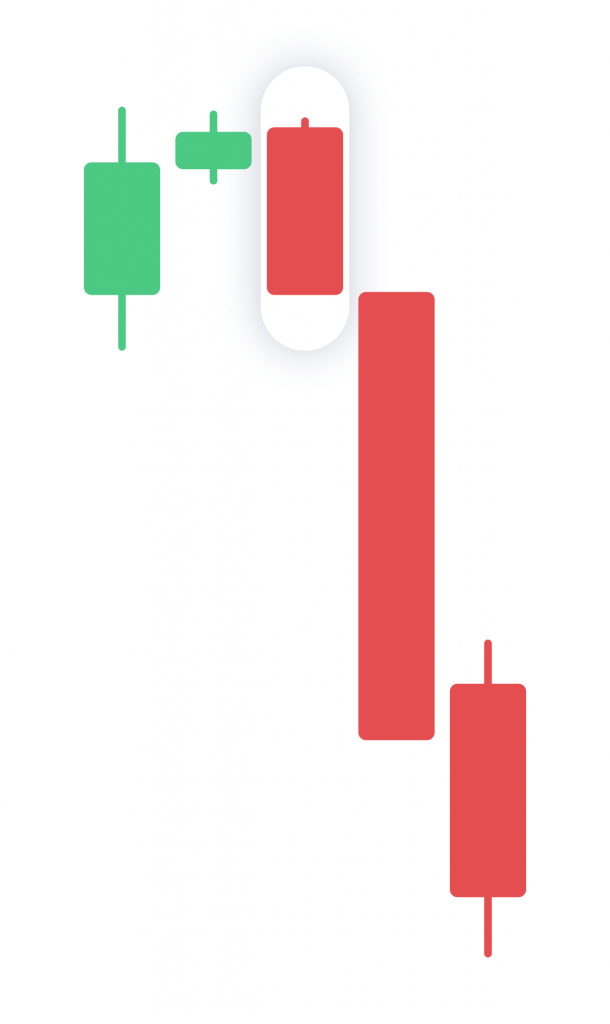

The utilization of candlestick analysis stands as one of the most advantageous and commonly used technical analysis techniques. This method provides predictions on potential price shifts based on historical data. In this guide, we explore the 9 most prominent candlestick patterns that can aid in forecasting cryptocurrency prices more precisely.

Given that the cryptocurrency market is relatively nascent, it hasn't yet reached peak efficiency. Consequently, chart price movements are mainly reliant on the market participants' sentiments.

Understanding Cryptocurrency Candlestick Analysis

Given that the cryptocurrency market is relatively nascent, it hasn't yet reached peak efficiency. Consequently, chart price movements are mainly reliant on the market participants' sentiments.

Candlestick analysis emerges as an essential instrument for projecting possible alterations in asset prices, drawing from historical data.

Munehisa Homma, an 18th-century Japanese rice trader, pioneered the basics of candlestick patterns. He advocated for a price change chart that could also serve analytical purposes. Currently, Japanese candlesticks are the preferred method for rapid price movement analysis among traders.

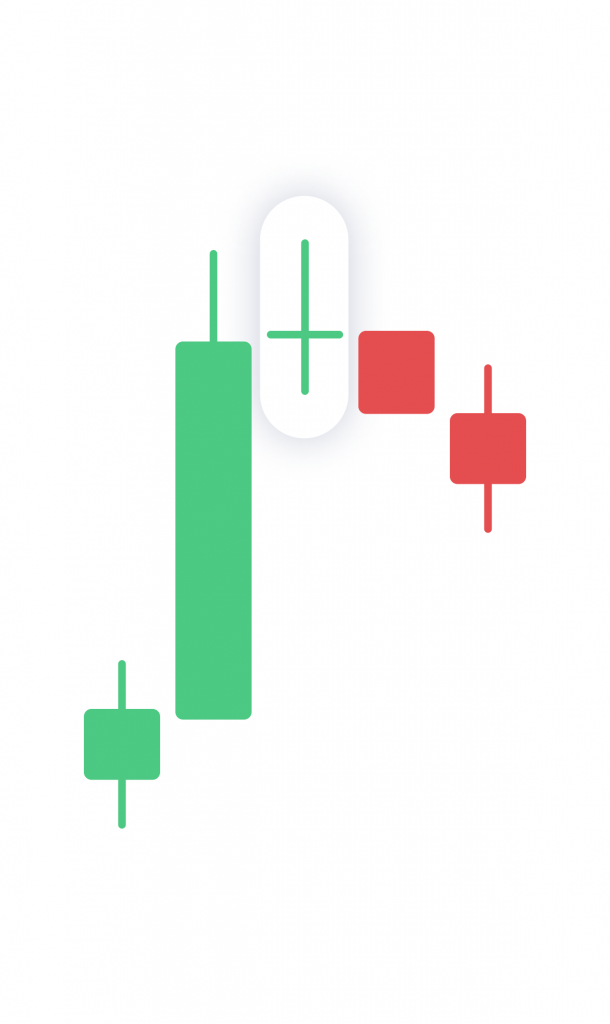

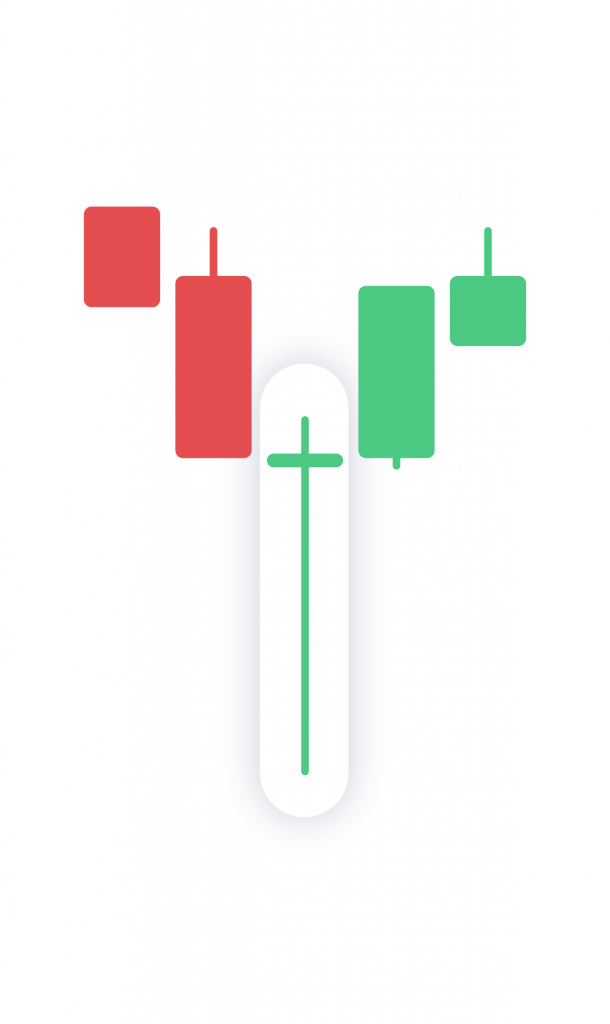

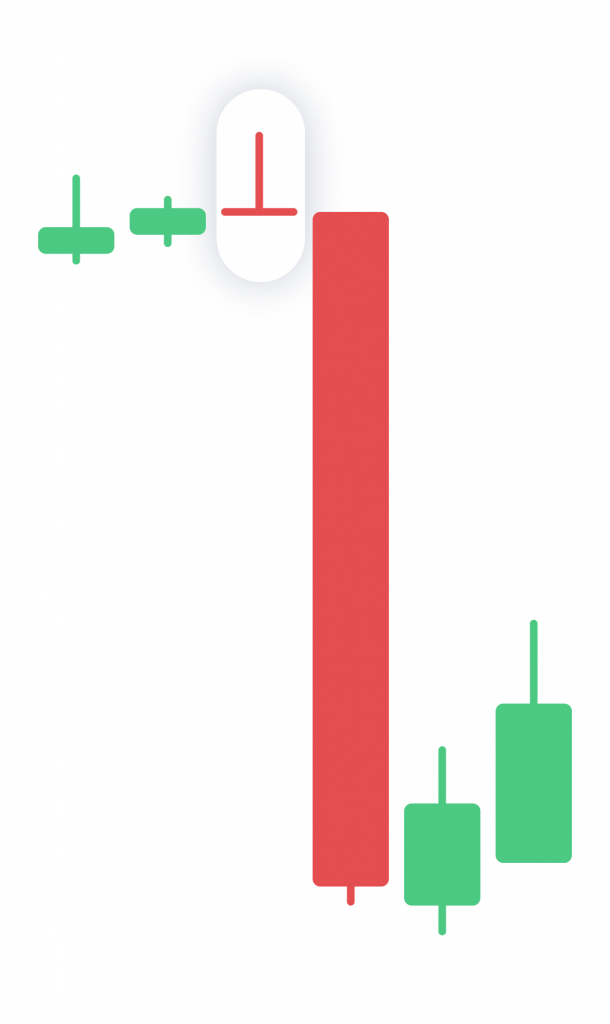

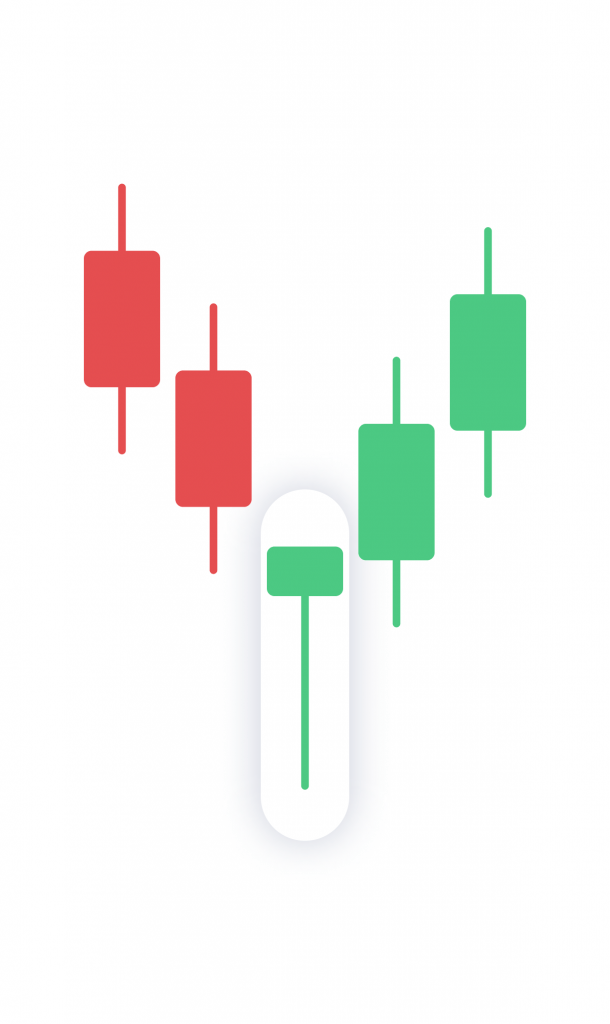

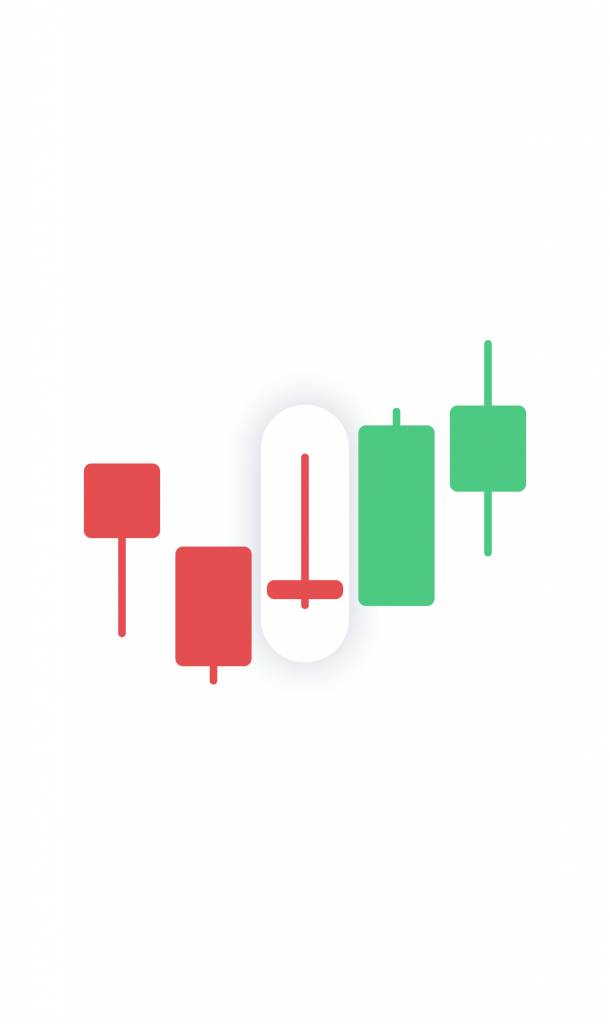

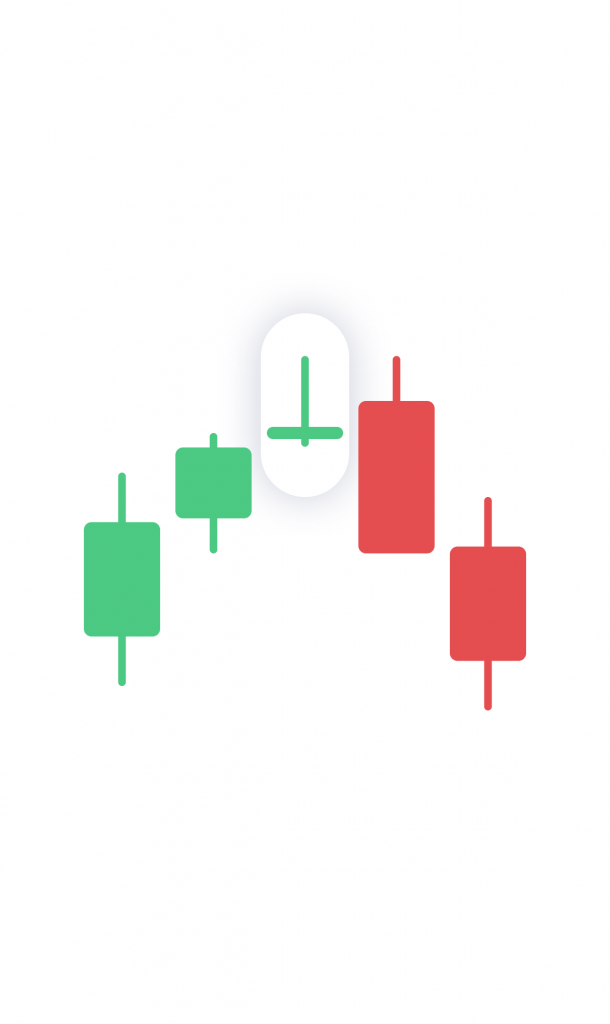

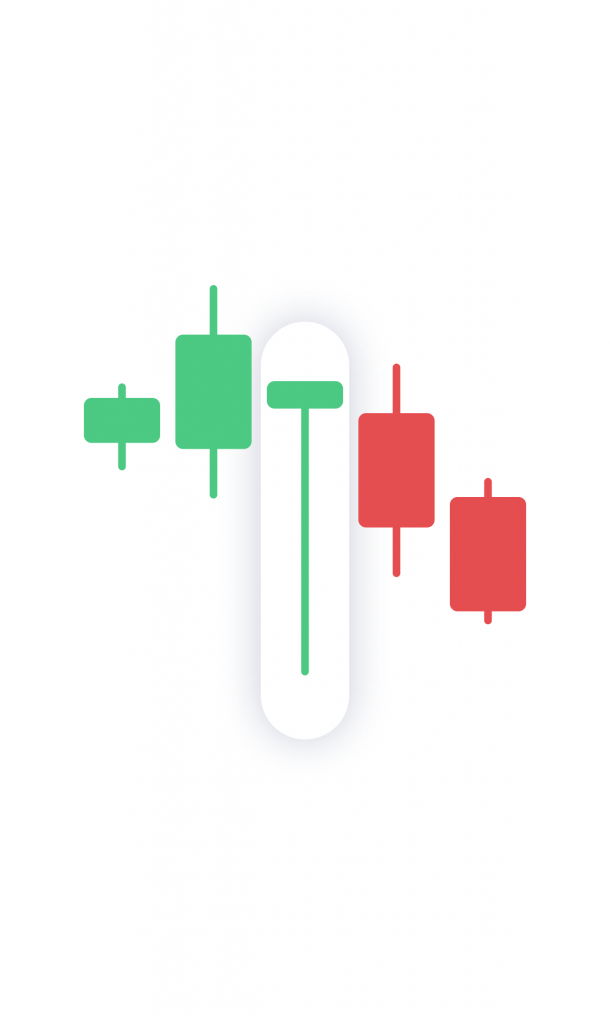

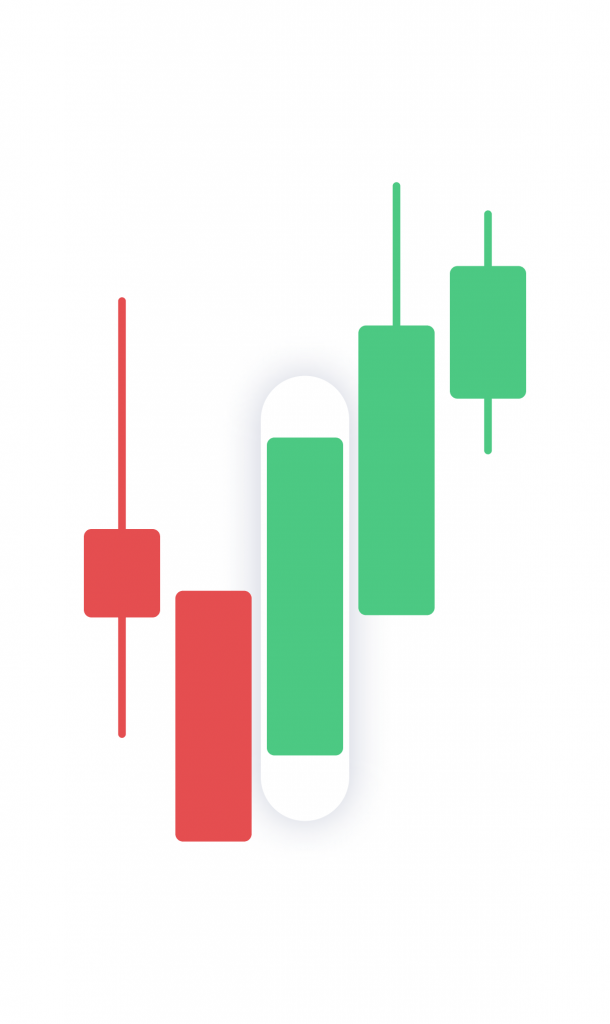

Highlighting the Top 9 Single Candlestick Patterns

Highlighting the Top 9 Single Candlestick Patterns

In conclusion, understanding and leveraging the top nine cryptocurrency candlestick patterns can be a highly effective tool in predicting price trends and making informed trading decisions. These patterns, deeply rooted in historical data, help decipher market sentiments and anticipate potential shifts in market trends. Regardless of the relative infancy of the cryptocurrency market, these patterns act as a significant cornerstone for anyone aspiring to navigate the world of crypto trading successfully. Therefore, traders, both novice and seasoned, can benefit significantly from familiarizing themselves with these patterns to enhance their market analysis capabilities.