The ISO 20022 roster showcases digital tokens and coins that adhere to the International Organization for Standardization's (ISO) 20022 benchmark. As these cryptocurrencies align with the forthcoming financial framework known as ISO 20022 compliance, many anticipate a significant surge in their valuation post-implementation.

At the core of digital transactions, we have Digital Token Identifiers (DTIs) – specific symbols or numbers signifying digital currencies. However, a challenge arises when banks try to distinguish between different digital token transactions. While distinguishing between "USD" and "AUD" is straightforward for bank systems, the same cannot be said for differentiating between "Bitcoin" and "Bitcoin Cash."

Based in Geneva, Switzerland, the ISO is an independent international body responsible for crafting global standards for a multitude of sectors including industrial and commercial. When an ISO standard gets recognized, it's almost universally accepted by financial entities globally. For instance, a universally acknowledged ISO code for Bitcoin (BTC) could significantly propel its global acceptance.

This article offers an insight into ISO 20022's foundation and presents a compilation of cryptocurrencies that are in line with the ISO 20022 standards.

What is ISO 20022?

ISO 20022 stands as a global framework designed to streamline and secure the exchange of financial messages among entities in the payments sector. This modern protocol is set to replace the longstanding SWIFT messaging system, a half-century-old mechanism used by banks and various financial establishments to conduct worldwide payments.

This standard responds to the demand from financial enterprises for a universally recognized communication language. Such a language offers them the capability to execute business strategies and cooperate with associates through a singular, integrated platform.

Entities like banks, cryptocurrency firms, and stock trading companies stand to gain immensely from ISO 20022. The system fosters seamless and potent dialogue across diverse branches and entities, thus minimizing the expenses linked with multiple communication frameworks. Furthermore, ISO 20022 promotes compatibility between prevailing protocols and caters to specialized financial operations, positioning it as a prime option for businesses in the financial realm.

The Significance of ISO 20022 in Modern Finance

The ever-evolving landscape of finance necessitates that financial institutions remain at the forefront of technological innovation to stay competitive. With the emergence of the "ISO 20022" standard, cryptocurrencies that align with its guidelines may potentially be allotted ISO codes. Such an alignment can pave the way for centralized banking systems to endorse them, facilitating global cryptocurrency transactions via these established institutions.

As we transition to a cutting-edge quantum financial system, all external players, including cryptocurrencies, must be adept at utilizing the ISO 20022 format. This standard underscores a pivotal benchmark for entities of every scale in their pursuit of adapting and integrating forward-thinking solutions.

A notable advancement over conventional banking formats, ISO 20022 accommodates larger data capacities and expedites processing. This makes it especially suitable for instantaneous transactions, daily funds management, compliance verifications, and identifying and countering fraudulent activities. In essence, ISO 20022 stands both as a golden opportunity and a formidable challenge for firms aiming to be technologically ahead in the financial curve.

Key Factors to Consider When Transitioning to ISO 20022

For crypto enterprises contemplating the shift to the ISO 20022 framework, there are several pivotal aspects to bear in mind:

Infrastructure Preparedness: The existing payment system, comprising both software and hardware components, needs to be ISO 20022-compatible. This includes ensuring the capability to relay and acknowledge messages in the appropriate format.

Regulatory Adherence: It's imperative for entities to guarantee that their platforms are in line with vital legislations, including laws against money laundering.

Data Safeguarding: Given the sensitivity surrounding monetary transactions, it's paramount to certify that the infrastructure is fortified against breaches and can shield consumer information.

Implementation Expenses: Transitioning to ISO 20022 can carry significant costs. Firms should weigh these against potential benefits before making the leap.

Program Oversight and Backing: Effective transition necessitates a solid foundation for managing the process. This encompasses the presence of a specialized team, robust surveillance and reporting mechanisms, and comprehensive personnel training.

Strategic Upsides of ISO 20022: Before migrating, businesses should deliberate on the strategic advantages associated with ISO 20022, including operational streamlining and potential cost reductions.

ISO 20022 Crypto List Advantages: The ISO 20022 Crypto List brings multiple perks for stakeholders. By showcasing compliant digital assets, it instills confidence in their alignment with recognized benchmarks.

Resource and Training Needs: Adequate staff training is essential to ensure the proper application of the ISO 20022 framework. Furthermore, entities should ensure accessible resources such as guides and support desks to aid in smooth adoption.

Customer Outreach: Organizations must prioritize informing their clientele about the infrastructural metamorphosis and potential risks related to ISO 20022. Educated customers can act as a first line of defense against potential fraud and security threats.

Handling Novel Data Dimensions: Transitioning to ISO 20022 might introduce new data variables. Organizations need to be equipped with the requisite tools and methodologies to handle these fresh data nuances.

Compliance with ISO 20022 Standards

As of now, there isn't a formal certifying body overseeing ISO 20022 compliance. However, the ISO 20022 Registration Authority (RA) and the Technical Support Group (TSG) offer a Compliance Checklist for ISO 20022. This document serves as a guide for those incorporating, adopting, or utilizing ISO 20022 messages. It aids in evaluating conformity to the standard and guarantees that entities consider the essential elements of ISO 20022 compliance.

ISO 20022 Compliance Checklist

When transitioning to ISO 20022, there are key components to address to ensure adherence to the standard, which in turn facilitates better compatibility across systems. This checklist highlights critical areas for consideration, ensuring that organizations structure their implementations in line with ISO 20022, thereby bolstering system interoperability.

Here's a breakdown of the primary components of the checklist and their respective explanations:

Official ISO 20022 Message Definitions Usage: Messages should be grounded in the formal ISO 20022 message definitions as disseminated by ISO and accessible via the ISO 20022 website.

ISO 20022 Business Transactions: This alludes to the specific business action or operation the message is geared towards supporting. Adhering to the set of business transactions delineated by the ISO 20022 standard is imperative.

Adherence to ISO 20022 Message Structures: Messages must be congruent with the architectural and content regulations set out by the ISO 20022 standard.

Upholding ISO 20022 Constraints: Messages should respect constraints set by the ISO 20022, including factors like maximal length, prescribed data types, and specific permissible values for certain fields.

Utilization of Registered Code Values: Any codes integrated into messages should be derived from code directories that are officially registered and overseen by ISO.

Incorporation of the Business Application Header: This is a standardized header infused in every ISO 20022 message, offering insights into the message, such as its classification, originator, and recipient.

Engagement with Supplementary Data Extensions: These extensions provide room for incorporating extra details in messages beyond the boundaries set by standardized message definitions. It's pivotal that these extensions conform to the guidelines established by ISO.

Although adherence to the checklist doesn't equate to an official certification, it serves as a pivotal instrument for self-evaluation and alignment with ISO 20022 standards. Implementers and users can harness the checklist to confirm they've thoroughly tackled the core components of ISO 20022 deployment, thereby minimizing potential pitfalls linked to miscomprehension or non-adherence.

Furthermore, sector-specific entities and regulatory authorities might establish their bespoke guidelines or prerequisites for embracing ISO 20022 within their respective arenas. It's imperative for organizations to juxtapose these unique requirements with the broader counsel offered by the ISO 20022 Compliance Checklist.

Advantages of Compliance

Conforming to ISO 20022 can yield multiple dividends for the realm of cryptocurrencies. Below are some of the prominent perks:

Uniformity and Compatibility: ISO 20022 carves out a universally recognized blueprint for messaging in transnational payments, inclusive of cryptocurrencies. This alignment ensures smooth interactions between different financial platforms and institutions. Such harmonization paves the way for a swifter, more secure movement of funds across diverse channels, amplifying the acceptance and integration of cryptocurrencies into mainstream financial structures.

Boosted Regulatory Adherence: Such compliance enables cryptocurrencies to resonate better with regulatory stipulations. As authorities shape blueprints for digital commodities, echoing global standards like ISO 20022 can accentuate their dedication to regulation, fostering stronger ties with conventional financial avenues. This can uplift the cryptocurrency image, cementing trust among watchdogs and traditional financial stakeholders.

Fusion with Central Banking Systems and Financial Hubs: Adherence grants an inroad for central global banks and monetary entities to weave cryptocurrencies into their centralized frameworks. Notably, some cryptocurrencies, including Ripple (XRP), XDC, Stellar Lumens (XLM), Iota, and Algorand, have already stepped into the ISO 20022 fold. Such conformity magnifies their potential to be weighed for roles like digital backup currencies or being part of central bank-driven payment setups. This alignment can heighten liquidity, surge transaction rates, and broaden the acceptance spectrum of these digital assets.

Revamped Transnational Payments: ISO 20022's vision is to refine the fabric of cross-border payment mechanics. By echoing this norm, cryptocurrencies can drink from the well of swifter, economically viable payment workflows, cutting down bottlenecks and ramping up global transactional efficiency. This not only amplifies cryptocurrency allure for global trade and remittances but also broadens their application palette, augmenting their functional value.

Bolstered Trust and Clarity: Adhering to ISO 20022 can fortify the trust and openness quotient in the crypto sphere. The standard rolls out an organized framework for payment dialogues, enhancing comprehension and minimizing the chance of discrepancies. Such lucid, normed communications foster clarity, trim down scam possibilities, and reinforce the integrity of cryptocurrency dealings.

In wrapping up, it's pivotal to underscore that the ripples of ISO 20022 on the cryptocurrency sector are still unfurling. The complete bouquet of its dividends will crystallize as the uptake of ISO 20022 gathers momentum.

Cryptocurrencies Aligned with ISO 20022 Standards

For a cryptocurrency to align with the ISO 20022 benchmark, it stands the chance of receiving endorsement from central banks which are inclined towards crypto transactions. The introduction of ISO-standardized crypto denominations is poised to redefine the cryptocurrency landscape. When ISO assigns a specific tag to a cryptocurrency, like Bitcoin or Ether (ETH), it paves the way for its incorporation into the systems of premier financial entities, such as Visa and MasterCard.

For a cryptocurrency to be recognized as a bona fide currency by ISO, it must not only align with the emerging norms of global financial infrastructures but also possess an ISO tag that doesn't overlap with pre-existing ones.

Here's a lineup of nine (9) digital coins and tokens that have secured their status as ISO 20022-aligned:

Quant (QNT)

Quant (QNT) is a pioneering blockchain initiative focused on reshaping the interaction between diverse blockchains and conventional financial infrastructures. Central to Quant's mission is the goal of achieving interoperability. This term signifies the frictionless integration and synergy between varied blockchain platforms and established financial setups. To this end, Quant has unveiled the Overledger - a groundbreaking platform crafted to act as a universal interlink, facilitating cross-blockchain transactions, data exchange, and the creation of decentralized applications (dApps) that span several blockchains. Through Overledger's advanced technology, it bridges the communication gap between different distributed ledger systems, ensuring smooth and secure value transfer across them. Such a level of interoperability holds the potential to magnify the blockchain universe's capacity, liquidity, and versatility, leading to a richer and more integrated decentralized environment.

Within the Quant framework, the QNT token holds pivotal importance. As the inherent utility token of the ecosystem, QNT is the medium for transactional costs, accessing Overledger's offerings, and rewarding those who uphold and fortify the network. With its supply set at a constant, the token's inherent deflationary nature can bolster its value proposition. As Quant's innovative solutions gain traction, it might set the stage for enhanced synergy among diverse blockchain platforms and lay down pathways between the decentralized world and traditional finance. By confronting the interoperability hurdle head-on, Quant is poised to usher in a wave of innovative prospects, streamline international transactions, and amplify the blockchain's footprint across varied sectors.

Ripple (XRP)

Ripple (XRP) stands out as both a cryptocurrency and an innovative digital payment framework designed to redefine international financial exchanges. Instead of aligning with traditional blockchain structures that depend on proof-of-work or proof-of-stake systems, Ripple employs its distinct Ripple Protocol Consensus Algorithm (RPCA). The RPCA ensures rapid and streamlined transactions by achieving consensus across a trusted node network, eliminating the need for energy-draining mining operations. Ripple's core mission centers on equipping financial establishments and banks with a swift, cost-efficient mechanism for cross-border payments and remittances, presenting a competitive alternative to the conventional Swift infrastructure. Within the Ripple system, the XRP cryptocurrency serves as an intermediary, enabling effortless conversions between diverse fiat currencies.

RippleNet, one of Ripple's standout offerings, is a comprehensive global payment grid that interlinks banks and payment facilitators, ensuring quick and secure international financial transfers. Through tools like its Interledger Protocol (ILP), Ripple aspires to diminish transaction durations and drastically reduce associated costs, ultimately boosting transparency and liquidity management for financial entities. Ripple's strategic alliances with influential names in the financial sphere have positioned it at the cutting edge of blockchain-integrated financial advancements. However, the journey has not been without obstacles. Ripple has grappled with regulatory questions, particularly concerning XRP's designation as a security by certain regulators, leading to legal wrangles and impacting its market valuation. Notwithstanding these hurdles, Ripple's unwavering commitment to transforming global payment systems continues to fuel its growth and integration aspirations.

Stellar (XLM)

Stellar (XLM) stands out as both a cryptocurrency and a distributed payment framework, committed to accelerating secure, economical international transfers and advocating global financial accessibility for individuals and enterprises alike. Originating as an offshoot from Ripple's blueprint, Stellar aspires to establish a comprehensive network that brings together monetary bodies, transaction facilitators, and everyday users. This cohesion simplifies global monetary exchanges and widens the reach of crucial financial offerings. The Stellar network leans on its proprietary Stellar Consensus Protocol (SCP), which expedites transaction validations by a set of recognized nodes, bypassing the need for energy-intensive mining operations.

Lumens (XLM), the intrinsic cryptocurrency of Stellar, acts as the intermediary asset streamlining currency conversions and underpinning international monetary exchanges. Additionally, Lumens play an indispensable role in thwarting malicious activities, thereby bolstering the stability and trustworthiness of the Stellar environment. Beyond its fundamental payment attributes, Stellar places significant emphasis on endorsing small-value transactions and fostering the creation of digital commodities through its inherent decentralized exchange features. This adaptability renders Stellar particularly apt for utilities like money transfers, asset digitization, and pioneering financial accessibility in areas bereft of established banking systems. Embedded in Stellar's philosophy is the vision to weave a universally available and integrative financial framework.

Hedera (HBAR)

Hedera Hashgraph (HBAR) stands out as an avant-garde decentralized platform that harnesses the power of the Hashgraph consensus algorithm. This unique approach ensures unparalleled scalability, fortified security, and uncompromised fairness. Designed as a bedrock for the evolution of decentralized applications (dApps) and services, Hedera caters to a vast spectrum of sectors, spanning from financial services and logistics to interactive gaming and social platforms. Distinct from classic blockchain architectures, Hedera Hashgraph employs the advanced directed acyclic graph (DAG) design, which guarantees a swift consensus mechanism among network users. This results in light-speed transaction processing paired with environmentally friendly low energy usage.

The HBAR token, the inherent digital currency of the Hedera ecosystem, plays pivotal roles in various capacities. It is the linchpin for settling transaction expenses, fortifying the network via staking, and engaging in the consensus paradigm. With its predetermined supply and inherent value-preserving mechanisms, HBAR showcases a compelling value narrative. Another distinguishing feature of Hedera is its commitment to robust security measures and a governance model steered by a consortium of esteemed enterprises across diverse sectors. This consortium actively participates in the network's strategic decision-making and operational governance. Hedera's blend of decentralization with real-world pragmatism positions it as a formidable contender for entities looking to harness a scalable, fortified platform for decentralized solutions.

IOTA (MIOTA)

IOTA (MIOTA) stands out in the world of cryptocurrency and distributed ledgers with its keen focus on the burgeoning Internet of Things (IoT) domain. Instead of following the conventional blockchain model, IOTA breaks the mold by introducing the Tangle, a specialized directed acyclic graph (DAG) format. The Tangle's genius lies in its capability to efficiently process microtransactions and data transmissions between IoT gadgets without incurring fees. In this innovative framework, each incoming transaction is responsible for verifying two preceding ones, enhancing both efficiency and security with growing transaction volumes. This mechanism makes IOTA an ideal choice for fostering machine-to-machine interactions and the intricacies of microtransactions that dominate the IoT realm.

The MIOTA token, intrinsic to the IOTA ecosystem, powers transactions and data movements within the Tangle. Its inherent absence of transaction fees paves the way for frictionless small-value exchanges, positioning it as a front-runner for IoT-related microtransactions. IOTA's dedication to achieving high scalability, fortified security, and fluid transaction processes is in sync with its aspiration to be a cornerstone technology for the ever-expanding IoT sector. Yet, IOTA hasn't been without its challenges, notably concerns regarding the potential centralization around its Coordinator node, a measure deemed essential for maintaining network integrity. As the IOTA project continually refines its framework to overcome these hurdles, it stands poised to reshape the IoT sector by introducing a distinct paradigm for decentralized data and monetary exchanges.

XDC Network (XDC)

XDC Network, anchored on the XinFin Hybrid Blockchain, emerges as a progressive blockchain platform that prioritizes efficient, secure cross-border transactions, while also enhancing trade finance and streamlining supply chain processes. By adeptly merging the strengths of both public and private blockchains, XDC Network crafts a dynamic, scalable, and interoperable environment. A key objective of the platform is to harmonize the realms of conventional finance and avant-garde blockchain technology, thereby optimizing international trade operations and diminishing supply chain bottlenecks. Underpinning the network is the innovative XDPoS (XinFin Delegated Proof of Stake) consensus mechanism, which guarantees swift transaction validations without compromising the principles of security or decentralization.

The XDC token, intrinsic to the network, functions not only as a medium for transactions but also as an access key to a range of services on the platform and as an instrument for network governance participation. What distinguishes XDC from the plethora of other blockchain solutions is its unwavering commitment to practical, real-world applications, with a special emphasis on revolutionizing trade finance and supply chain management. By leveraging its capabilities for integration and interoperability, the XDC Network is poised to redress longstanding inefficiencies in global trade and finance. The ultimate goal? To usher in a new era where international transactions are not only more streamlined and transparent but also within reach for businesses and individuals globally.

Algorand (ALGO)

Algorand, symbolized by its native cryptocurrency ALGO, emerges as a cutting-edge blockchain platform designed for the creation of decentralized applications (dApps) and the streamlined processing of blockchain operations. Standing distinct in its approach, Algorand's groundbreaking consensus algorithm, known as Pure Proof of Stake (PPoS), offers a swift transaction validation process, sidestepping the centralization pitfalls of other models. Unlike the traditional proof-of-work methods, the PPoS model of Algorand guarantees egalitarian opportunities for participants to both suggest and endorse new blocks, fortifying network security while abolishing the necessity for energy-draining mining.

Playing a dual role, the ALGO token acts as a conduit for transactions and a key to engage in the consensus dynamics of the network. By holding ALGO, users are empowered to partake in the authentication of blocks and, in return, receive compensatory rewards. Algorand's dedication to scalability, coupled with its minimal transaction costs and accelerated validation times, renders it apt for a myriad of uses, spanning from conventional financial platforms to the burgeoning decentralized finance (DeFi) sector and the realm of asset digitalization. Given its unwavering mission to provide a robust and efficient blockchain foundation, Algorand stands tall as a formidable player, striving to tackle the perennial issues of scalability and transaction latency, all while nurturing ingenuity in the decentralized world.

Cardano (ADA)

Cardano, represented by its token ADA, stands out as a pioneering blockchain framework dedicated to crafting a reliable and adaptable foundation for decentralized applications (dApps) and intricate smart contracts. Born from an extensive research-centric methodology, Cardano zeros in on three key principles: scalability, longevity, and cross-functionality, aiming to rectify the drawbacks seen in earlier blockchain iterations. The platform ingeniously segregates its functions across two planes: the Cardano Settlement Layer (CSL) for cryptocurrency dealings and the Cardano Computation Layer (CCL) dedicated to the execution of smart contracts. Spearheading Cardano's consensus mechanism is Ouroboros, a proof-of-stake model championing network fortification and sustainable energy consumption, while enabling users to gain incentives by staking their ADA holdings.

ADA, as the lifeblood of the Cardano ecosystem, dons multiple hats.

It functions as a transactional medium, a staking tool, and an instrument for users to voice their opinions on platform direction, from suggesting enhancements to endorsing new features. Through its multi-layered design, Cardano endeavors to amplify blockchain capacity, driving transformative solutions in realms like finance, identity verification, and logistics. Beyond its technical prowess, Cardano's commitment to scholarly assessments and academic alliances exemplifies its ambition: weaving rigorous academic insights with tangible tech applications to deliver a resilient and forward-looking blockchain infrastructure.

It functions as a transactional medium, a staking tool, and an instrument for users to voice their opinions on platform direction, from suggesting enhancements to endorsing new features. Through its multi-layered design, Cardano endeavors to amplify blockchain capacity, driving transformative solutions in realms like finance, identity verification, and logistics. Beyond its technical prowess, Cardano's commitment to scholarly assessments and academic alliances exemplifies its ambition: weaving rigorous academic insights with tangible tech applications to deliver a resilient and forward-looking blockchain infrastructure.

Verge (XVG): Prioritizing Privacy in Cryptocurrency Transactions

Verge (XVG) stands out as a cryptocurrency dedicated to ensuring user privacy, prioritizing anonymous and secure transactions. Employing an amalgamation of privacy-enhancing technologies, notably Tor (The Onion Router) and I2P (Invisible Internet Project), Verge masks transaction details and users' IP addresses, fortifying privacy and safeguarding users' data. The overarching vision for Verge is to usher in a digital currency that facilitates decentralized transactions, allowing participants to engage without exposing their identity or transaction specifics.

Cryptocurrencies like Verge are conceived with the aim to democratize global transactions. This inherent nature might expedite their adaptation to the ISO 20022 standard.

However, the evolving landscape of the crypto realm will undoubtedly see the ISO 20022-compliant list expand, especially as more digital coins venture into the global payment sector. It's essential to note that alignment with ISO 20022 doesn't inherently signify a wise investment choice.

Take Ripple, for instance. While it complies with the standard, it presents a slew of challenges that might outweigh its advantages, leading Helena Margarido to caution against it.

On the other hand, Hedera presents itself as an intriguing underdog in the crypto space, brimming with potential. It's worth delving deeper into Hedera and perhaps considering it for your observation list.

Verge (XVG)Token, the latest ISO 20022 - Compliant Asset

On June 5th, Verge made an impactful announcement: its principal token, XVG, has successfully become ISO 20022-compliant. This pivotal move enhances Verge's standing in the cryptocurrency market, giving its token XVG an edge and fueling the prospects for its broader adoption.

This adaptation to the ISO 20022 standard underscores Verge’s significant stride within not just the cryptocurrency sector but the more extensive digital currency domain. Verge now joins the ranks as the 9th digital currency to embrace this standard. Yet, Verge stands out for a specific reason: it's the first decentralized, community-operated Internet of Things (IoT) currency to attain ISO 20022 certification.

This landmark achievement was realized in tandem with Voice Life and BlockDudes. While Voice Life introduced an innovative facet—proposing passive income distribution for Fractional Non-Fungible Token (F-NFT) holders via the XVG coin, BlockDudes played an instrumental role, overseeing the intricate alignment process to ensure a smooth integration.

Coming on the back of a recent declaration that Verge would not be classified as a security, this accomplishment further underscores the cryptocurrency's significance. With a mission rooted in bridging the crypto world with conventional financial modalities, Verge stands as a testament to the ideals championed by the mysterious Satoshi Nakamoto, Bitcoin's originator.

Despite the fact that ISO 20022 standards weren't originally designed keeping the nuances of digital currencies in mind, Verge's transition to compliance is particularly commendable. Such a move anticipates expanding XVG’s reach and fortifying its stature in the international fiscal ecosystem. Verge's recent announcement encapsulates this feat as a transformative chapter in its odyssey, signifying the promising trajectory of digital currencies.

ISO 20022 in 2023: What's New?

In 2023, ISO 20022 is poised for a series of revisions. The ISO 20022 Crypto List Committee is set to broaden the range of compliant digital currencies and tokens while reevaluating the standards for their admission. Furthermore, enhancements geared towards bolstering security and curbing fraudulent operations are on the horizon.

Emerging functionalities like cross-chain compatibility and atomic swaps are anticipated to be integral to these updates, facilitating seamless conversions between different cryptocurrencies for users.

SWIFT's Adoption of ISO 20022: A New Era in Global Payments

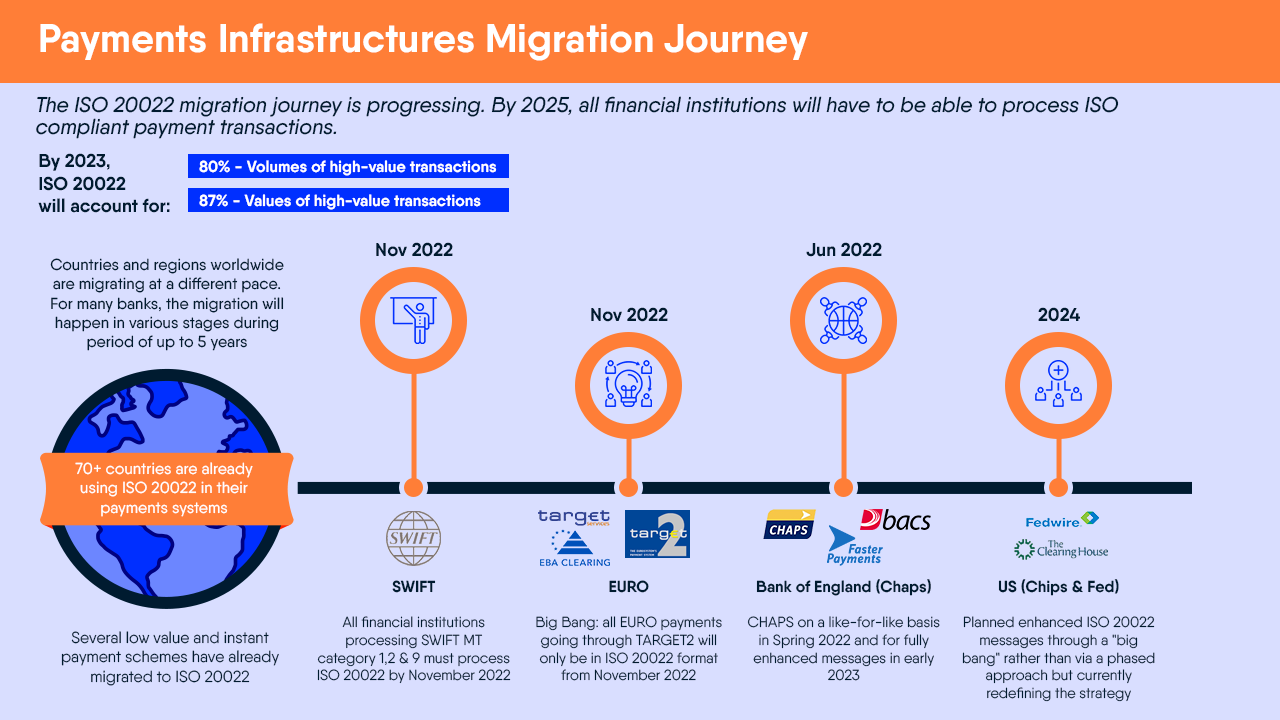

March 20, 2023, marked the commencement of SWIFT and ISO 20022's coexistence for cross-border payments and reporting, often referred to as CBPR+. This pivotal move signifies an evolution in the international payments domain. Until November 2025, during this coexistence timeframe, SWIFT will extend support for both MT (Message Type) formats and ISO 20022. This approach ensures financial institutions can transition to the updated standard according to their unique timelines.

The inception of this phase underscores the importance of a gradual adoption of ISO 20022, accommodating the diverse readiness levels across various institutions. As a leading force in secure financial messaging services globally, SWIFT pledges unwavering assistance throughout this phase, ensuring seamless integration of ISO 20022 and its organized data into the financial sector.

Simultaneously, SWIFT is also championing the cause for real-time gross settlement systems (RTGSs) to incorporate ISO 20022 for their local transactions. Major market frameworks, including but not limited to Australia’s RITS, Canada’s LYNX, Europe’s EURO 1 and T2, and New Zealand’s ESAS, transitioned to ISO 20022 on the said date. Numerous other RTGSs globally are on the cusp of embracing this standard, with launches expected in the imminent future.

The collective endorsement of ISO 20022 by SWIFT and RTGSs fosters a more uniform and standardized landscape for both cross-border and domestic financial transactions. The introduction of organized data provides augmented clarity, streamlined operations, and augmented analytical potential. Ultimately, the harmonious integration of SWIFT and ISO 20022 is a stepping stone towards refined global payment procedures, ushering in a fresh wave of possibilities for the worldwide payments realm.

Implications of ISO 20022 Adoption on Financial Industry Stakeholders

Adaptation Hurdles: Corporations might need to reconfigure internal systems and processes, investing in both technological upgrades and staff retraining.

Risk Oversight Elevation: Adopting a uniform format elevates capabilities related to risk oversight and market surveillance.

Tech Solution Entities

The transition of SWIFT from MT to the ISO 20022 standard is on the horizon. To stay aligned with this evolution, banks are mandated to revamp their messaging systems and subject them to rigorous testing before the November 2022 deadline, ensuring seamless compatibility with this modernized payment communication protocol.

In pursuit of standardizing high-value payments and fortifying real-time gross settlement (RTGS) mechanisms, a collaboration has formed amongst SWIFT, global central banks, and prominent market infrastructures, resulting in the inception of the HVPS+ market practice task group.

The adoption of ISO 20022 in the financial sector has ripple effects that touch a myriad of stakeholders, from financial establishments to tech solution providers. The outcomes of this adoption can swing from beneficial to challenging, based on readiness and unique contexts of each participant. Here's an analysis of the potential ramifications across various industry actors:

Banks and Payment Service Providers

Operational Enhancement: By adopting a consistent messaging protocol, ISO 20022 streamlines operations, curbing manual interferences and reducing transactional discrepancies.

Data Enrichment: This standard grants these institutions deeper, structured data insights, enhancing aspects like fraud detection, risk management, and customer interactions.

Regulatory Conformity: Certain transaction types might require mandatory adherence to ISO 20022, urging system modifications and procedural tweaks.

Expense Impacts: Transitioning to ISO 20022 can lead to notable costs related to system overhauls, personnel education, and data transition.

Corporate Entities

Transaction Efficacy: The adoption facilitates elevated straight-through processing (STP) rates, thus reducing human efforts and potential inaccuracies.

Elevated Insight: With ISO 20022's enriched data scope, corporations obtain a clearer view of their fiscal operations, optimizing cash flow and treasury functions.

Adaptation Hurdles: Corporations might need to reconfigure internal systems and processes, investing in both technological upgrades and staff retraining.

Infrastructure Facilitators (e.g., Clearinghouses, Payment Platforms):

Interactivity Enhancement: ISO 20022 facilitates improved interaction between infrastructures, smoothing out both domestic and international transactions.

Risk Oversight Elevation: Adopting a uniform format elevates capabilities related to risk oversight and market surveillance.

Transition Challenges: Transitioning to ISO 20022 from older formats can be intricate and demanding for these providers.

Tech Solution Entities

Opportunity Expansion: These providers can devise specialized solutions to support industry players in their ISO 20022 journey.

Innovation Boost: The uniformity of ISO 20022 can be a catalyst for fintech advancements, fostering new application and service creation.

Regulatory Bodies

Augmented Oversight: The enriched transactional visibility aids regulatory entities in better monitoring and governance of the financial realm.

Promotion of Uniformity: Regulators can further industry-wide standardization by endorsing ISO 20022 for distinct transaction types.

In essence, while ISO 20022 offers a plethora of efficiency and data-depth benefits, the transitional journey can pose challenges, calling for tech enhancements and procedural shifts. However, a successful embrace of ISO 20022 positions entities to proficiently meet evolving financial and regulatory dynamics.

Global Ramifications of the ISO 20022 Standard

The introduction of the ISO 20022 standard heralds a transformative phase in the financial domain, poised to revolutionize international monetary transactions. As Europe gears up for its transition to ISO 20022 by the end of 2022, the US has marked its adoption for 2023.

Cryptocurrencies aligning their blockchains to this evolving ISO standard stand a good chance of witnessing a surge in value, especially if they become the go-to for bank-based transactions.

This standard has found resonance in over 70 nations, with financial powerhouses like Switzerland, China, India, and Japan integrating ISO 20022 into their payment architectures. This extensive adoption speaks volumes, considering the standard can streamline over 200 diverse payment modalities. By bridging the chasm between divergent payment protocols, ISO 20022 creates a cohesive system where varied payment methods can now seamlessly interact.

Encompassing a broad spectrum of transactions, from domestic and ACH to real-time, high-value, and cross-border payments, the ISO 20022 standard is set to usher in an era of global financial cohesion and streamlined operations.

Strategic Moves for Banks Amidst Rising Competition

The transition of SWIFT from MT to the ISO 20022 standard is on the horizon. To stay aligned with this evolution, banks are mandated to revamp their messaging systems and subject them to rigorous testing before the November 2022 deadline, ensuring seamless compatibility with this modernized payment communication protocol.

The tidal shift in the payment sector towards instantaneous transactions is exerting considerable pressure on banks. If they don't migrate swiftly to this emergent standard, they risk rendering their current offerings obsolete in the face of relentless competition.

The ISO 20022 stands out from traditional legacy formats in its sophistication, adaptability, and capacity for more extensive data processing. Consequently, the onus is on banks to ensure their systems and data repositories are geared up for these heightened demands. This encompasses everything from real-time transactions, day-to-day liquidity management, to stringent compliance reviews, and meticulous fraud detection measures.

It's imperative for banks to allocate ample time for comprehensive testing. This is to guarantee the precision of syntax, format, and seamless migration of data across all intertwined payment and clearance frameworks. To maintain a competitive edge, such testing endeavors should be wrapped up by the outset of the second quarter in 2022.

Furthermore, a transparent dialogue with corporate clientele is paramount. Banks should enlighten them about the augmented data capabilities and its potential applications. Ensuring clients are well-versed and actively participating in the end-to-end testing phase is essential for a seamless transition.

Streamlining High-Value Payments with ISO 20022

In pursuit of standardizing high-value payments and fortifying real-time gross settlement (RTGS) mechanisms, a collaboration has formed amongst SWIFT, global central banks, and prominent market infrastructures, resulting in the inception of the HVPS+ market practice task group.

Michael Knorr, who leads Payments & Liquidity Management for Financial Institutions at Wells Fargo Bank, opined, "Standardizing messaging for HVPs will not only usher in operational efficiencies but also pave the way for innovative financial offerings."

To effectively manage and oversee these potent payment networks, one necessitates a robust and agile monitoring solution. Given the paramount role of HVP systems in the global financial landscape, ensuring meticulous oversight and effective performance management of these substantial monetary transfers is of utmost importance.

Challenges of ISO 20022

The introduction of ISO 20022 brings about both opportunities and hurdles for financial institutions. Here's an overview of the challenges faced during its implementation:

Nuances of the Standard: ISO 20022 is intricate, replete with regulations and stipulations. Institutions must delve deep into its structure, ensuring their operations align with the stringent rules, including areas like anti-money laundering (AML), fraud detection, and compliance.

Variances in Market Frameworks: Despite uniform adoption of the standard, differences may arise in the implementation guidance across market infrastructures. Such disparities necessitate meticulous navigation by institutions to guarantee cross-system interoperability.

Legacy System Overhaul: The persistence of outdated systems poses a barrier, often demanding upgrades to harness ISO 20022's potential. Such transitions require careful budget allocation and stakeholder collaboration.

Synchronized Migration Planning: Deadlines for adoption are not universally consistent. Institutions with global operations must craft a phased migration strategy, factoring in the varied timelines and intrinsic challenges.

Balancing Speed and Precision: Amidst concurrent transformative initiatives and regulatory pressures, the urgency to adapt is palpable. Nevertheless, hasty roll-outs risk inefficient solutions. Institutions must judiciously weigh prompt compliance against their overarching organizational vision.

Data Management Overhead: ISO 20022's messages can be denser than their predecessors, heralding an uptick in data volume. A strict adherence to formatting is paramount, with validation checkpoints peppered throughout the communication pathway. Minor discrepancies, as trivial as a misplaced punctuation, can ripple into impactful ramifications.

To adeptly tackle these challenges, institutions should anchor their migration approach on:

Strategic Vision: Any migration blueprint should seamlessly dovetail with the institution's broader objectives, embracing the prospects the standard proffers.

Holistic Impact Assessment: An exhaustive evaluation can spotlight potential pitfalls and risks, priming institutions to pre-emptively counter them.

Structured Project Oversight: A well-orchestrated project blueprint is fundamental. This entails clear governance, judicious resource allocation, and a methodical rollout sequence.

Transparent Communication: Keeping all concerned parties in the loop is pivotal. This encompasses internal teams, collaborators, and clientele, ensuring everyone's aligned with the migration's implications.

Innovative Tech and Thorough Testing: Institutions should gravitate towards cutting-edge solutions that are compliant, scalable, and future-ready. Before and post-migration, rigorous system vetting is crucial to ascertain seamless operability.

In distilling these challenges and embedding key principles into their migration framework, financial entities can adeptly traverse the ISO 20022 implementation journey, optimizing the dividends from this transformative standard.

Summing Up

The inception of ISO 20022 traces back to the collective efforts of the "Registration Management Group," a consortium of 37 leading financial heavyweights, among which Ripple (XRP) is a notable member. Ripple's senior leadership touts its platform as being ISO 20022-compliant, positioning RippleNet as potentially the premier crypto entity aligned with this impending global financial paradigm.

The dawn of the ISO 20022 protocol signals a monumental shift in the payments landscape. Endowed with enhanced security and reliability, it promises to bolster operational efficacy and curtail fraudulent activities across global financial institutions. As the countdown to its 2023 roll-out ticks away, stakeholders are pressed to gear up for a smooth pivot to harness the manifold advantages inherent in this avant-garde protocol. Its prowess in managing voluminous payment data is poised to recast the global payments milieu.

The constant flux of technological evolution, regulatory revisions, and the ushering in of global payment benchmarks presents a formidable challenge. Yet, as the horizon of ISO migration draws near, there's an unprecedented opportunity for entities to metamorphose raw data into actionable insights, fortifying the robustness and efficacy of global payment mechanisms.

Fast forward to 2025, ISO 20022 is forecasted to emerge as the de facto standard for high-value payment ecosystems across all major reserve currencies. It's anticipated to shoulder a staggering 80% of global transactions, representing a value of approximately 87%. Reinforcing its pivotal role, both the European Central Bank and SWIFT have already earmarked their respective launch dates for this transformative standard.

Understanding ISO Standards

ISO standards serve as global benchmarks outlining specifications for products, services, and processes. Specifically, ISO 20022 is a renowned standard in the financial sector that governs the exchange of messages related to payments.

Impact of ISO 20022 on the Payments Sector

Adopting ISO 20022 necessitates organizations to reevaluate and modify their methods of processing, retaining, and disseminating payment details.

Who Oversees ISO Standards?

The mantle of endorsing and releasing ISO standards rests with the International Organization for Standardization (ISO). Moreover, based on regional and contextual factors, various governments and regulatory entities might mandate adherence to these standards.

Relevance of ISO 20022 to Cryptocurrency

With ISO 20022 facilitating comprehensive payment data exchanges, it becomes increasingly streamlined for cryptocurrency dealings to align with global norms, especially those pertaining to anti-money laundering (AML) and combatting the financing of terrorism (CFT).